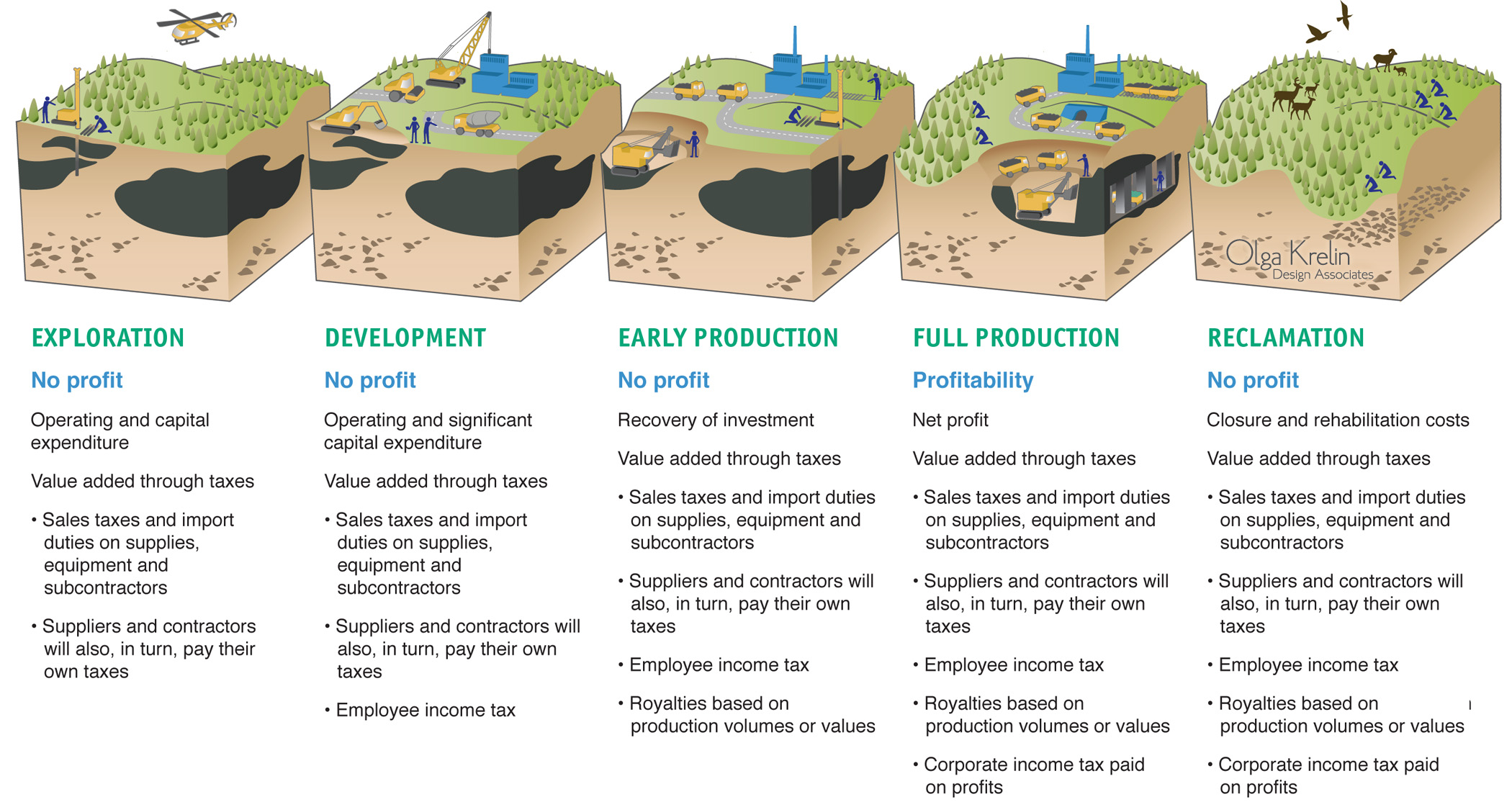

I wanted to share a very interesting graphic that we developed for a client. Exploration and mining are risky business, commodities prices rise and fall, but one thing remains constant… you guessed it – taxes.

While the tax revenue generated by a project grows during development and ultimately peaks during full production certain tax streams are present for the entire life cycle. At all stages, the payments to suppliers and contractors are subject to sales tax or import duty. From exploration to reclamation, income tax is being generated by hundreds of employees. Every company the project does business with at each stage pay their own taxes as do their employees.

When you add in the royalties on production volumes and the corporate income tax paid on the eventual profit, not to mention the corporate social responsibility commitments to local stakeholders it’s no surprise most governments welcome new mining projects. A permit for exploration has the potential to turn into a 20 to 30 year source of tax revenue.

So the mining business must really seem like investing on a geological time scale. Sure an investor can see a return as the share price increases but from the company’s perspective it takes a long time to see that investment recovered and earn a profit. Then some of that profit must be held to cover the costs of decommissioning the mine and reclamation of the site.

Critics of the mining sector focus on profits and the extraction processes, leading to poor public perception. It is valuable to see the entire story in order to help develop social license for future projects.

EXPLORATION

No profit

Operating and capital expenditure

Value added through taxes

- Sales taxes and import duties on supplies, equipment and subcontractors

- Suppliers and contractors will also, in turn, pay their own taxes

DEVELOPMENT

No profit

Operating and significant capital expenditure

Value added through taxes

- Sales taxes and import duties on supplies, equipment and subcontractors

- Suppliers and contractors will also, in turn, pay their own taxes

- Employee income tax

EARLY PRODUCTION

No profit

Recovery of investment

Value add through taxes

- Sales taxes and import duties on supplies, equipment and subcontractors

- Suppliers and contractors will also, in turn, pay their own taxes

- Employee income tax

- Royalties based on production volumes or values

FULL PRODUCTION

Profitability

Net profit

Value add through taxes

- Sales taxes and import duties on supplies, equipment and subcontractors

- Suppliers and contractors will also, in turn, pay their own taxes

- Employee income tax

- Royalties based on production volumes or values

- Corporate income tax paid on profits

RECLAMATION

No profit

Closure and rehabilitation costs

Value add through taxes

- Sales taxes and import duties on supplies, equipment and subcontractors

- Suppliers and contractors will also, in turn, pay their own taxes

- Employee income tax

- Royalties based on production volumes or values

- Corporate income tax paid on profits